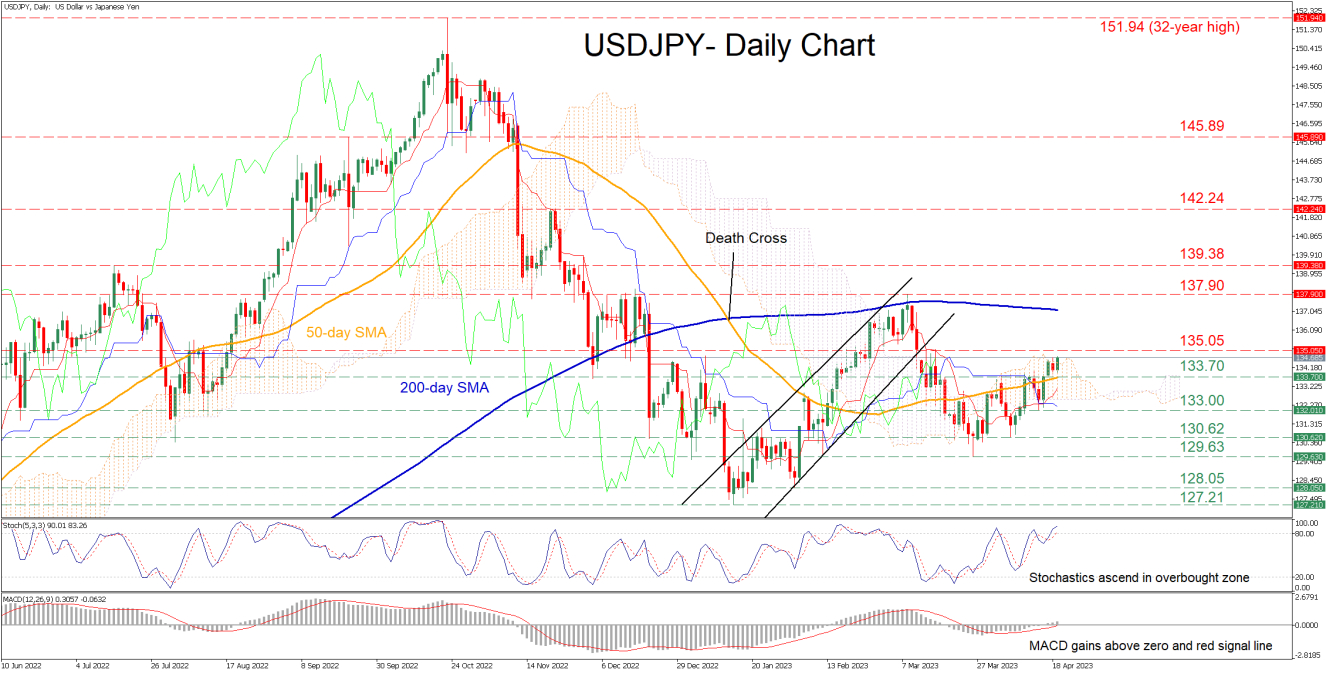

The momentum indicators currently suggest that bullish forces are in control. Specifically, the stochastic oscillator is ascending within the 80-overbought zone, while the MACD histogram is strengthening above both zero and its red signal line.

If the pair manages to extend its advance, initial resistance could be found at the 135.05 hurdle. Violating this territory, the price may ascend to challenge the 2023 peak of 137.90. Should that barricade fail, the bulls could then aim for the July 2022 high of 139.38.

On the flipside, should the recent recovery fade and the prices reverses downwards, the 50-day SMA at 133.70 could act as the first line of defence. Dipping lower, the pair might test 133.00 before the April bottom of 130.62 comes under examination. Further retreats could then come to a halt at the March low of 129.63.

Overall, USDJPY’s latest rebound seems to have paused after encountering strong resistance but the technical picture has not turned bearish yet. Therefore, a strong exit from the Ichimoku coupled with a break above the 135.05 resistance is needed to revive bulls’ hopes for a sustained uptrend.